Wonga Mobile Adverts

I'll preface this by saying that Wonga's lawyers are far better than mine.

Wonga, the payday loan company, has found itself in a bit of hot water recently. They've had an Advertising Standards Authority adjudication against one of their adverts and they have raised the ire of Stella Creasy MP over their sponsorship of the Tube on New Years.

people should be aware of the extortionate rates of interest that they can charge and people should not enter into irrational or unwise debt obligations

Now, I'm not convinced that payday loan companies are bad per se. If you need a few hundred pounds to avoid being thrown out of your home, these companies can provide a service which traditional banks can't - or won't - provide. That said, taking out a loan is something which should not be done lightly - and should only be done with the full facts at your disposal.

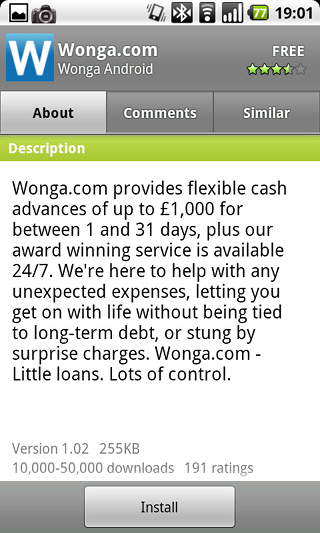

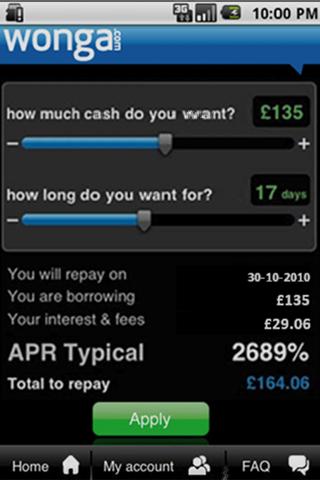

That's why I'm confused by Wonga's latest advertising campaign on mobile. Here are three adverts that I've spotted recently.

![]()

![]()

![]()

None of them display the APR - even though there is sufficient room to do so. I suppose they could argue that they are advertising the Wonga Android App - not a loan. Therefore they don't need to display the APR. I'm not convinced that's a sound argument - more on that in a moment.

Within the marketplace description, there's no mention of the APR.

Only one of the screenshots mentions the APR.

Only one of the screenshots mentions the APR.

I've been taking a look at the CAP guidelines and recent adjudications, and the OFT FAQs on this subject and I'm left a little confused as to whether hiding the APR in this way is allowed.

Is it simply enough to say

"I'm not advertising [banned product] - I'm advertising an app that lets you get it."?

If so, I think the guidelines need to change.

Two Questions

- Are Wonga in breach of the ASA and OFT codes governing advertising for financial products?

- Does this trivialise money lending?

I'm not saying that Wonga are in breach of the rules. I don't even wish to raise a complaint against them. I will be asking the ASA and OFT for clarification on this matter.

As for the app itself, it's reasonably well crafted. While it's great that you can do so much with a phone, I remain a little uneasy about applying for complex financial products while on the bus. But perhaps I'm getting old. I'm sure that next year I'll be applying for a mortgage via a mobile website and not think it anything strange.

Now With Extra Irony

In one of those delightfully serendipitous moments, a Wonga advert popped up as I was reading Stella Creasy's tweets.

Tony says:

S P says:

So, I've raised a query with Consumer Direct.