I'm absolutely addicted to the Reddit's UK Personal Finance forum - where people mutually support each other through the difficult world of managing one's personal finances. It's a great community and full of people eager to help others.

In amongst the confusion around pensions, tips for budgeting, and complaining about debt-collectors is a persistent drumbeat encouraging people to save money. Good! More people should save more money. But the advice is always undercut with the message "sticking money in a savings account will see it eaten away by inflation".

Is that true?

Firstly, what is inflation? Simply put - prices rise and fall. The price of bread goes up by 50% and a loaf now costs £1.50. The price of a 42 inch flat screen TV drop by 50% and now costs £150. The average person buys 50 loaves of bread per year and a new TV every 5 years - add up the average of what people buy and you have a rough idea of what inflation is0.

Secondly, what is interest? Simply put - a bank or building society will pay you money to save with them. If you put £100 in a savings account paying 5% interest then leave it a year, you'll be given a fiver1.

If the rate of inflation is higher than the rate of interest, your savings will be eroded; your money will be worth less.

The Bank of England's current interest rate and inflation rate shows this:

On average, if something cost £100 a year ago, today it will cost £103.20. If you had saved £100, it would be worth £103.75

So, based on this, savings exceed inflation right?

Well, as ever, it is a little more complicated than that!

For starters, the inflation rate is for the last year and the interest rate is the current rate.

The UK publishes a number of different inflation statistics. Depending on which one you prefer, the inflation rate over the last 12 months is between 3.2% and 4.4%.

Different savings accounts will attract different interest rates. Some will offer tasty bonuses to new savers and will drop to nothing once that promotion expires.

This stuff is hard to accurately model.

But let's ignore all that and YOLO it!

Here's two resources:

- The Bank of England inflation calculator tells you want a historic price is in today's money (up to 2025).

- The website HistoricalSavingsCalculator.com provides the annual average historical interest rate from the Bank of England (up to 2023).

As a quick check. £1,000 in 1975 is equivalent to about £7,300 in 2023.

The same amount saved in 1975 with average interest compounded, would be worth about £18,000 in 2023.

Amazing! Compound interest beats inflation!

But let's take another perspective. £1000 in 2008 is equivalent to £1,540 in 2023

£1,000 saved in 2008 would be worth about £1,180 in 2023.

A loss of over £300.

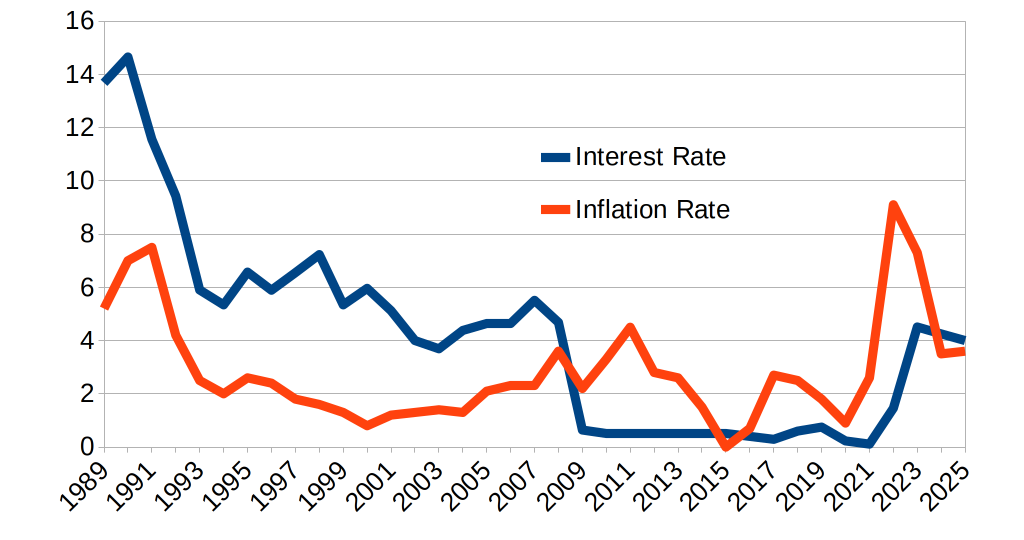

Let's stick annual UK inflation and interest rates into a graph:

Ah! Over the last 17 years, inflation has been higher than interest - a position which is slowly reverting. Fucking 2008, eh?

It looks like we might be entering a period where interest will be higher than inflation. Does the average person optimally pick their savings accounts? Probably not. Is inflation a 100% reliable way of tracking the worth of money? Also probably not.

While cash savings are unlikely to exceed the rate of return from "Dollar Cost Averaging", it is possible that savings accounts will once again offer some protection against inflation.

One thought on “Do savings accounts really lose money to inflation?”

@blog Interesting, 2008 really did break so many things.

Now I need to find a dataset of savings account interest rates to compare them to the BoE base rate. It would be interesting to know how much space you need between the base rate and inflation for the average high-street savings account to be beating inflation.

| Reply to original comment on hachyderm.io

More comments on Mastodon.