How much money do banks owe you if you're scammed?

There's currently an open consultation about whether banks should have a lower compensation limit to refund their customers who have been scammed.

Currently, if a customer falls for an Authorised Push Payment (APP) scam, they may be eligible for up to £415,000 back from their bank. The proposal is to limit this to a maximum of £85,000.

What does this mean and is it a bad thing?

APP fraud is when a fraudster convinces you to send them money. This isn't about a bank being tricked, or identity theft, or robbers storming the building. It can be as simple as someone sending you a text saying "You owe HMRC £10,000 - please send it to ...". Or it can be as complex as someone sending you a fake email, supposedly from your solicitor, saying "Our bank details have changed. Please send your mortgage deposit to..." In some cases, it can be scammers building up a fake dating profile, or fake investment account, or similar.

Whatever the reason, you were scammed. You sent money to a scammer. Now you would like it back. Please.

How bad is the situation

The payment systems regulator have very detailed report about the state of APP fraud. It says:

Based on data provided by the 14 largest banking groups […] £341 million was lost to APP scams in 2023 Authorised push payment (APP) scams performance report July 2024

Yikes! That's a lot of money. They estimate 252,626 fraudulent transactions. I don't know if that's 252k victims or total transactions.

How much do people actually lose though?

2% of cases were higher value scams with losses over £10,000. […] Lower value scams involving sums of under £1,000 accounted for over 80% of all APP scam cases sent in 2023.

Here's the data in handy tabular form:

| Value | Volume | Share | Total Value | Share | Mean Value

per Scam |

|---|---|---|---|---|---|

| <£1,000 | 207,654 | 82% | £45,418,531 | 14% | £218 |

| £1,000 - £10,000 | 38,938 | 15% | £115,059,584 | 34% | £2,955 |

| >£10,000 | 5,610 | 2% | £175,090,459 | 52% | £31,210 |

An astonishing 2% of cases make up 52% of losses!

In the consultation briefing they mention that more than 400 cases of APP scams were over the proposed £85k limit, with roughly 18 being over the current £415k limit.

If those 18 were all, say, £500k - that would be about 2.7% of the total value!

If we assume the ones over £85k were worth on average £100k each, the total value of >£85k fraud is worth about £49 million. Approximately 15% of the total amount scammed from people. That's bonkers! 0.2% of fraudulent cases costing 15%.

Would a lower limit make a much of a difference to customers?

For the vast majority of customers, lowering the limit would make no difference.

But take a look at these two statistics:

In 2023, 67% of the money lost to APP scams was reimbursed.

In 2023, 80% of reported APP scam cases were fully or partially reimbursed.

Frustratingly, the data aren't broken down further. While it shows that some banks provide a full refund in over 90% of cases, there's no information on whether those were all low value scams.

It could be argued that having a lower absolute limit, but higher enforcement, would be better for customers in aggregate.

Wouldn't it be better to have a greater number of scam cases refunded - even if it meant some high value scams got nothing? Or to have even more of the total refunded - but have a tiny amount of people lose out?

Hell, you could lower the limit to £10k and easily afford to give 97% of victims a 100% refund.

Would that be worth it? It has a certain utilitarian charm - but perhaps isn't acceptable.

What are the downsides of keeping a higher limit?

There's a comprehensive cost benefit analysis from last year, which contains several comments from banks.

Briefly, there arguments against a higher limit are:

- Only 5% of fraudulent funds are recovered - so there is a huge cost to the banks and their customers.

- Increasing friction might stop some fraud, but would annoy and disrupt customers performing legitimate transfers.

- Banks might be tempted to refuse the custom of vulnerable people.

- There's a "moral hazard" in letting people know they'll always be refunded; they'll take fewer precautions.

Frankly, I find it hard to disagree with those arguments. Compensation is expensive - and that ultimately gets passed on to all customers. It is annoying when I have to jump through hoops to make a normal payment. Here's a story about how a bank refused a legitimate transaction saying they thought it was a scam.

How would you feel if you or your parents were kicked out of your bank because they thought you were likely to fall for (another) scam?

And, I do seriously wonder if people will be more lackadaisical when confronted with scams if they know they'll get refunded.

But there's a major issue left undiscussed. Are banks really to blame here?

Why is this the bank's responsibility?

For some scams, like ID theft, I agree that banks are probably liable. But the "A" in APP stands for "Authorised". You have told the bank you want to do something with your own money. Do they have the right to stop you?

Let's consider purchase fraud.

If you take cash out of an ATM and hand it to some guy who then fails to give you the promised goods, that's not the bank's fault. Right? Why is it different when you send it electronically? The bank shows you a Confirmation of Payee screen to help you make sure you're sending it to the right people. They ask you to confirm that you understand you might not get the money back. They even monitor the amount of complaints about the receiving bank. I'd argue they go beyond their duty to protect their customers.

Of course, it isn't just purchase fraud - although that's the largest by volume - this is how the different scams are categorised, and their values.

| Scam Type | Volume | Volume % | Value | Value % | Mean Value

per Scam |

|---|---|---|---|---|---|

| Purchase | 176,685 | 69.94 | £85,169,655 | 25.00 | £482 |

| Investment | 10,611 | 4.20 | £68,732,511 | 20.18 | £6,477 |

| Impersonation: Police / Bank | 10,357 | 4.10 | £65,705,019 | 19.29 | £6,344 |

| Impersonation: Other | 24,384 | 9.65 | £46,497,418 | 13.65 | £1,907 |

| Romance | 4,824 | 1.91 | £27,454,960 | 8.06 | £5,691 |

| Advance Fee | 22,623 | 8.96 | £26,613,253 | 7.81 | £1,176 |

| Invoice and Mandate | 2,188 | 0.87 | £17,416,604 | 5.11 | £7,960 |

| CEO scam | 189 | 0.07 | £1,680,239 | 0.49 | £8,890 |

| Unknown | 765 | 0.30 | £1,382,950 | 0.41 | £1,808 |

| Totals | 252,626 | £340,652,609 | £1,348 |

Have a read of this account of an investment scam. The bank did everything they could to stop the customer from being scammed. How did the customer react?

[the bank] even questioned whether the money was being invested in cryptocurrency but because [the scammer] had warned this may happen, she lied and said no.

Or read about this romance scam. Was the bank negligent in letting an elderly man send £153,000 to scammers?

The bank blocked a number of transactions, it spoke to [the victim] on the phone to warn him and even called him into a branch to speak to him face-to-face.

Obviously the cases which make the news aren't necessarily representative of the many and varied ways people can get scammed.

Is this a consumer choice problem?

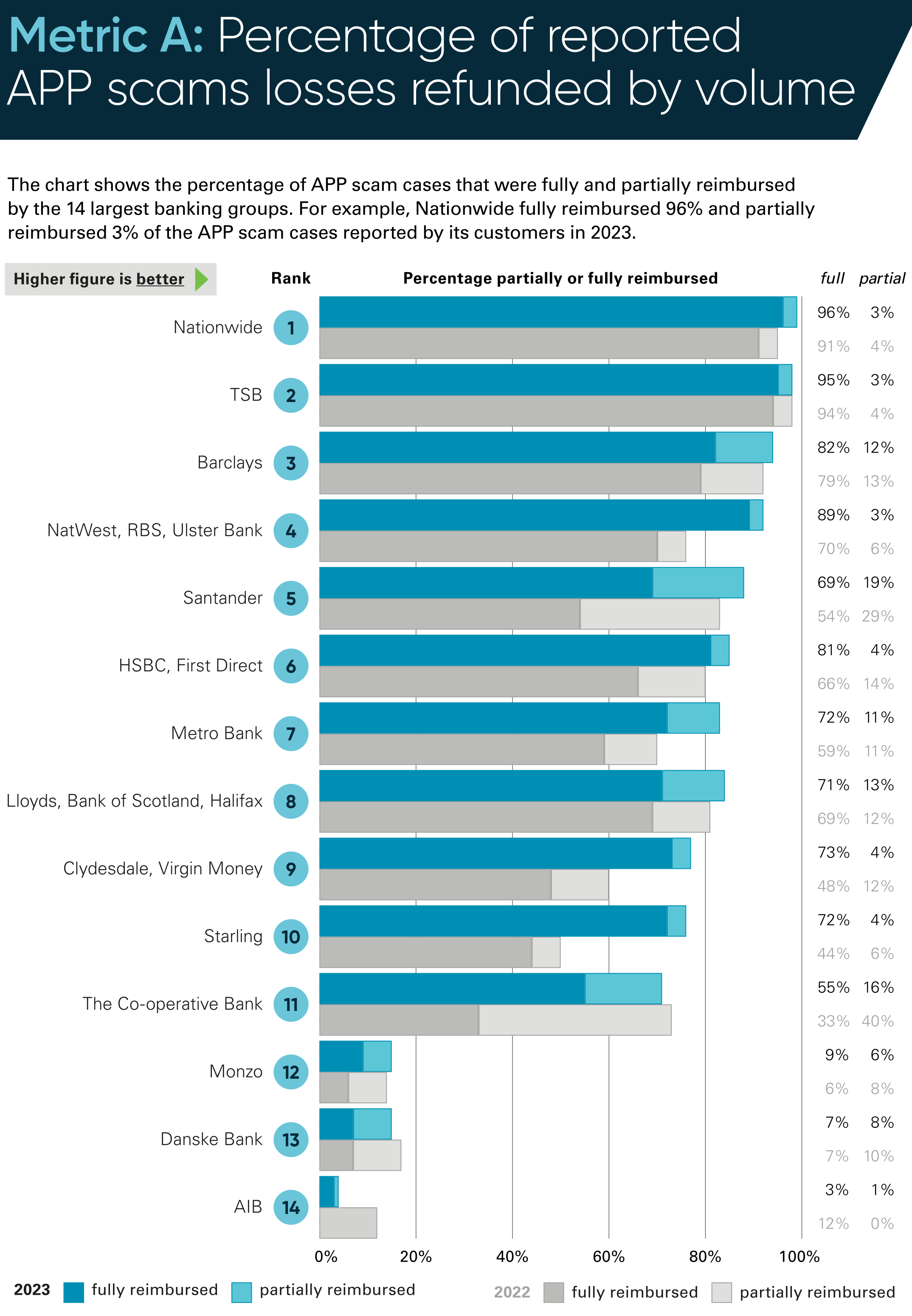

One of the most interesting graphs in the report is this "Percentage of reported APP scams losses refunded by volume". Which bank are you with?

If you're with Monzo and get scammed... you're probably not getting your money back! Nationwide members get excellent customer service.

Perhaps banks should be required to prominently display their scam refund likelihood. Would you switch to a different bank if you knew they were more likely to refund you in the event of a scam?

Final Thoughts

One day, I am going to be successfully scammed. As I get older, I'll get more trusting. Or I'll be distracted. Or I'll be aggressively targetted. Or my email and phone will be hacked.

I want my money to be safe. I want it protected from scammers and - if necessary - from myself.

Fraudsters are terrifyingly good at what they do. They are manipulative, persistent, and organised.

I want my bank to be equally aggressive in chasing down scammers, publishing warnings, and protecting me.

But I genuinely don't know if it is their responsibility to refund me for any mistakes I make up to £415,000.

If you have strong feelings about this, I encourage you to reply to the consultation.

@Edent

Thank you for an interesting write-up and consideration of the pros and cons.

My initial reaction is perhaps counterintuitive; yes, it is ok to reduce the compensation limit.

Someone who is sending a large amount of money should be responsible for understanding the risk. I think in other parts of finance there is a concept of a 'sophisticated investor'.

People who send just a couple of thousand are less likely to really understand the whole situation.

I think the main thing I feel about this is basically that it should suck less to scammed out of money you can't afford by virtue of living in a society where you can at least hope that if you're screwed there's going to be support for you to have some basic living standards.

😱 9% only?! They can't be serious... I'm not their customer anymore but it's quite scary.

My view is that it is not banks responsibility and it causes problems that are more minor but a lot more widespread. It leads banks to impose more checks, which means more hassle and delays for customers. People get very frustrated when the cannot do what they want with their own money because the bank is checking for fraud.

As the case of the couple who lied shows it is very hard to protect people from themselves. Maybe there should be some channel for banks to raise concerns about people who seem to be vulnerable and have impaired ability to manage their own money.

@neil @Edent already I have to answer multiple questions and rounds of 2FA to transfer between my own bank accounts or to my sister and brother in law (as a contribution to my nephews birthday gift - I can understand the reasons for all of this (or even adding more checks), but I wouldn't be surprised if the more determined criminals go back to full scale robberies (with violence) of high value targets like they did back in the 90s...

More comments on Mastodon.