A year of going cashless - and where it hasn't worked

I set myself a resolution last year - go 12 months without using physical cash. No coins, no notes, no gold bullion, no cheques. I attempted to do all my spending on credit card, Direct Debit, and bank transfer (BACS).

It worked! Mostly... Here's where it didn't work, and what I learned from it.

Foreign Cash

Went to Hong Kong and withdrew £100 in local currency. Was completely unnecessary. Everywhere took card / contactless. We didn't stray away from the tourist trail, which may have helped. Carrying cash had a mixed effect on my anxiety. I was slightly nervous about getting mugged, but that was offset by knowing we could jump into a cab if we encountered any local difficulties.

Similarly, we went to Australia and took out the same amount of cash. We were driving in some fairly rural locations - although not the outback! - and wanted a small safety net. Again, completely unnecessary. Everything from parking meters to tiny ice-cream stands took contactless.

Spoke at a conference in Denmark. Was only a quick visit, so didn't take cash. Tried to buy a chocolate bar and drink in the train station, but was told my card wouldn't be accepted. I wasn't sure if it was the small sum, a foreign card, or something else. Bit weird, but the rest of the trip was fine.

Countless trips to the EU. I already had some € coins and notes. The first few times I took them - but they were never needed. Even in small bakeries my card or phone were accepted.

Emergency Cash

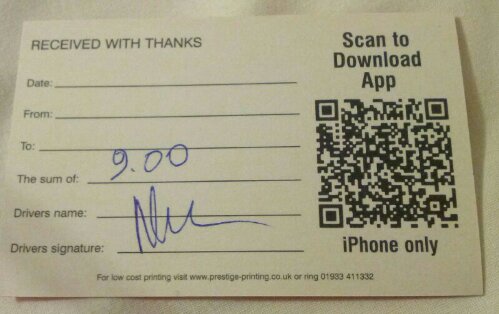

This was a horrific situation. I was due in hospital to undergo a surgical procedure and the minicab driver was screaming at me to pay him in cash. We'd booked the night before and paid in the cab firm's app. What we hadn't realised is that they'd outsourced the job to a different firm, who'd outsourced it to yet another firm. Somewhere along the way, the driver wasn't told it was a pre-paid fare.

We couldn't get hold of any of the firms so, reluctantly, we had to take cash out of an ATM using our credit card. We didn't have a debit card with us - because we never use it.

The cab firm eventually gave us a refund, and the credit card company agreed not to charge us their usual extortionate interest rates for cash withdrawal.

Lesson learned - always take a taxi which is required to accept card, or confirm with the driver before travelling.

Lunch

Most of the lunch stalls near my work take card. The ones that refuse don't get my custom.

Except for this amazing salad bar round the corner. I took out a couple of fivers to pay for a massive box of salad. I did ask the owner a few times if he'd consider taking card. He said the only way he could keep the price low was with minimal overheads. Considering how long the queue was to pay - which often prevented people entering the venue - I think it'd pay back quickly. But it's not my position to tell him how to run his business.

Cheques

LOL! I haven't paid with a cheque in years. Annoyingly, a few companies decided to send me refunds via cheque. My bank account doesn't have any local branches. So I either had to post them off, or use my backup bank. I think I'll start having to charge a cheque-processing-fee for old-fashioned companies.

I suspect that companies send out refunds by cheque because they know it's a pain. I bet lots of them go uncashed.

Odds and Sods

Our local off-licence tried to charge us an illegal card-fee. So I walked out and left the bottles on the counter. Then reported them to Trading Standards.

Similarly, a few places have insisted on a minimum transaction amount - this is against the terms of most providers. I've either picked up some sticks of gum, or bought elsewhere.

I received a few paper vouchers for a department store. They all had redemption codes, so I could use them online.

All of the plumbers and electricians I dealt with either accepted card or gave me their BACS details. A couple of clicks later and they were paid.

For group events at work, no-one wanted to deal with cash. We either transferred the money directly to whoever was organising things, or each paid separately.

Things I wasn't able to do

The UK doesn't have much of a tipping culture. I used to round up the bill, or add a fiver, if I was paying cash. These days, most places have a button on the credit card terminal with a suggested gratuity amount, or a free-form entry. I resent being forced to tip, so this seems like a sensible solution. Perhaps my tips don't go directly to the staff? That's not really my problem. Does that make me an arse?

No cash-in-hand discounts. Again, there's not much of a haggling culture in the UK. Occasionally I've been able to say "What's the best price you can do" but no money off for undeclared income.

Donating to charity. I don't give to people in the street, and I don't put coins in buckets. The majority of my charitable spend goes via Payroll Giving for tax purposes. But, most charities take contactless now:

Nifty! Charity using NFC payments to solicit for donations. pic.twitter.com/4hag3gzVET

— Terence Eden is on Mastodon (@edent) May 31, 2017

Privacy

Oh no! Someone can track my spending!!! I literally don't care. Middle-aged bloke spends too much on beer and electronic gadgets. Shock. I catch the same train to work each day. Scandal!

Perhaps I'm being naïve. I'm not involved in anything revolutionary or seditious. I'm not buying illicit pharmaceuticals or private entertainment services. Maybe I'm complicit in bringing forth a dystopia - but I place a high value on convenience.

Please argue in the comments about why I'm wrong.

Lessons

In the UK, if you live in a city and have a credit card, it is absolutely possible to live without cash. I'm lucky that the public transport options where I've lived are modern and accept contactless.

With the exception of an angry taxi-driver, no one has been upset that I didn't want to use cash.

The vast majority of my transactions were via Google Pay. I waved my phone near the terminal, and the rail barriers open as if by magic.

Foreign travel was painless - but we weren't exactly going off the beaten track.

Tracking my own spending using Money Dashboard became much easier. We can look at our household budget and quickly see where we're wasting money.

So, could you go cashless for 2020? If not, what's stopping you?

People Don't Want To Run Their Own Bank

People Don't Want To Run Their Own Bank

There are several services I use which are still cash-only, including the barbers and taxis (mainly because of the extortionate fees involved with processing card payments if you run a small business). I could probably substitute those for similar services which do accept cards, but that would involve leaving providers I trust for someone of unknown quantity or I don't want to use for ethical reasons.

Also, paying by cash in a restaurant, especially when there's a group of you, is so much easier than trying to split a bill and make 10 card payments. Tipping is easier too if you can leave some change on the table rather than having to say how much you want to tip on the card machine, and there's more chance of it actually getting to the staff.

The privacy element of cash is important too. I'm not doing anything dodgy, but I fundamentally dislike companies holding lots of data on my personal spending (and travelling, which is why my travel cards aren't registered). Even if they don't do anything with it, there are far too many cases where companies have been compromised and lost customer data. The less data they have, the less they can lose.

So whilst I could go cashless, I wouldn't want to as it would be inconvenient and involve a reduction in privacy.

I think I disagree with nearly everything you've written 🙂

Last time a big group of us went out for a meal, we said to the server "Can you put £30 on every card, please?" Tapping cards and phones on a terminal was a lot quicker than faffing with cash on a table.

The fees for card payments are pretty reasonable - once you take into account the costs and risks of dealing with cash. If you have to spend time cashing up, or need to buy a safe, or travel to a bank, or look out for dodgy currency - it all adds up. Given that tiny food stalls use iZettle or similar, I don't understand why cabs and barbers don't. Unless they're involved in something dodgy.

I get the privacy thing. But I balance it against it being harder for merchants to defraud me or the state. I value the protection of being able to do a chargeback more than I value MasterCard knowing I buy sprouts at Xmas. Sure, Dixons might lose my credit card details, but I'm protected against fraud and it takes me a button-click to get a new card number.

I wonder if some of the restaurant differences could be due to regional variations? Whenever I'm in London it feels like you're 5-10 years ahead on card payments (and don't get me started on Oyster vs Get Me There for transport). Up in Manchester splitting a bill by card can be a nightmare - often the restaurant doesn't know where the card machine is, doesn't know how to work it for anything other than the whole bill, accidentally charges the wrong amount and then the manager comes chasing us down the street for not paying enough... Chains tend to get it right but smaller outfits seem to struggle.

I agree on the merchant fraud thing - anything expensive or might be faulty/fake I buy on card for the consumer protection, and I have used chargeback (or the threat) a few times.

I think a lot of it is that small businesses focus on the business at hand and changing payment methods is friction they don’t want. I believe that contactless payments don’t have as high a charge anyway. I also think that the costs of processing card payments isn’t really what people think. A lot of banks will charge for handling cash and cheques from businesses anyway &, as you say, by the time you’ve factored in the hidden overheads of people time, etc, I suspect that it would be cheaper anyway.

One fun thing that caught out my son and myself when we went to Iceland earlier last year – I took no local cash at all by the way for the first time ever overseas – we couldn’t give our local walking guide a tip which I would have liked to have done since he was excellent – I wasn’t even carrying UK cash so had nothing to give him and he didn’t have a card machine. Hey ho.

In Sweden a couple of years ago, we shouldn’t have needed cash but found that there were a few street food stalls in Stockholm that only took cash.

I always carry some cash with me (notes only) in the UK but I only get anything out maybe once a quarter if that. As mentioned on Twitter, it is usually for the kids, not really needed but they sometimes prefer something in hand. My local barber and our favourite local Indian Takeaway were the last shops I use regularly with cash. The barber now takes cards though. Maybe the takeaway does as well, I haven’t actually asked recently.

If my kids weren't around I could quite easily go a year without cash. 😁

Why do they need cash?

Genuine question, I don't have any. Can't you give them a pre-pay card or something?

under 16s dont usually have contactless/cards connected to their life. Schools usualy ask us to prepay accounts which require them to provide fingerprint to pay for product. Meanwhile as a parent prepaid cards are not usually contactless and to an extent not easy to manage. Life with abank account and contactless card for a child is pretty hard and when I want to encourage a child to learn to socially interact and ask for things in society, eg. Ask for and pay for a Waffle whilst at a convention; it also involves talking about costs and handing some cash and asking how much change might be expected. Kids Kant Kashless Kwickly

A useful record - thanks!

I pay for almost everything using my watch now, and have done for quite a while. The supermarkets where I regularly spend more than 30 quid all have much higher contactless limits for payments made with Apple or Android; I think Waitrose told me it was £10,000! So much of my other shopping is on Amazon or similar that it’s rare for me to spend larger amounts elsewhere.

So, not only do I not need cash, on most days I don’t need a wallet, and have been known to go out of the house without it, something I would never have done in past decades. I did once find myself stuck needing to buy something for £60, but the shop was quite happy to split it across two separate contactless payments.

You have inspired me to start looking for a smaller wallet that just holds a few cards, rather than my old one which caters for great wadges of tenners...

Here's the Carbon Fibre wallet I use - https://shkspr.mobi/blog/2017/01/review-pitaka-carbon-fibre-wallet/ - card only.

Oh, that does look nice!

But I discover, on examining my current wallet, that once I've removed a couple of non-essential loyalty cards etc, I still have 17 cards left! That would make this rather an expensive (and I suspect bulky) option.

Only four of these are anything to do with payment - the others are keycards for doors, National Trust and English Heritage memberships, organ donor cards, etc. I must find a good system for storing that many cards! Recommendations welcome!

17!!! Google Pay lets you store some loyalty cards in there - see https://support.google.com/pay/answer/7644069?hl=en

The NHS App (my employer!) lets you register your organ donation preferences. TBH, I think the card is just a hangover from when records weren't digitised. From Spring, the law has changed to presumed consent - https://www.organdonation.nhs.uk/uk-laws/

Yes, I know - it does seem excessive!

4 payment (1 business plus 3 personal)

2 employment (university)-related

1 driving licence

1 medical exemption cert.

1 Waitrose

5 clubs & societies (NT, EH, camping & caravan club, etc)

and a couple of miscellaneous ones. (I discovered one had expired, so I'm down to 16!)

Even though I almost never take my wallet out of my pocket in normal use, each of these would on occasion cause inconvenience if I suddenly discovered I didn't have it. I wish I could just load them all onto my phone somehow!

I think this looks quite nice, though:

https://bellroy.com/products/card-pocket/default/navy

Might give it a try.

I have a Bellroy card sleeve (different model). It’s lovely.

I use Stocard for store cards, works really well.

Annoyingly, Barclaycard won't let me use my card with Google Pay though it works perfectly with Applepay. Generally I find it easier to pull out my card anyway. Using the phone is useful when you have forgotten your wallet of course! Did that on a business trip to London a few years ago - thankfully Lloyds Bank were great and let me have emergency money. Thank goodness they (reluctantly) accepted my Government ID card as proof of identity.

My contactless card can occasionally fail to work (even on payments of under £30), probably due to fraud avoidance (it reports "unauthorised"). If this happens in a shop, no problem -- I can just put it in the card reader and enter the PIN. If this happens on a bus, there's a problem: the buses don't have card readers (or at least the driver didn't know about it).

In this case, I asked the driver if he'd let me on anyway, and he did. I then unlocked the card by just paying for something in Leeds and entering the PIN -- I assume an ATM would also work. It hasn't happened since, but it was slightly embarrassing.

Moving towards a cashless society is sleepwalking into a world where negative interest rates (a tax on owning money and savings, oh joy!) will be the norm - this isn't a conspiracy theory, this is legitimate economic policy being seriously considered by the IMF to stimulate investment and spending in today's already low-interest rate world.

Don't take my word for it, there's plenty of online resources discussing this possiblity as per the following links:

https://www.actuaries.org.uk/system/files/field/document/A%20Cashless%20Society-%20Negative%20Interest%20Rate%20Policies%20August%202018%20addendum%20-%20disc.pdf

https://blogs.imf.org/2019/02/05/cashing-in-how-to-make-negative-interest-rates-work/

https://www.tutor2u.net/economics/blog/could-a-cashless-economy-help-central-banks-to-use-negative-interest-rates

The Scandinavian countries (Sweden, followed by Denmark & Norway top adoption of cashlessness) are already pioneering this approach and some say negative interest rates is the price to pay for living in such societies (in the same way "tax" is just the norm in many).

Others may react against this removal of personal choice and drive up adoption of alternate finance to replace "cash" i.e. cryptocurrencies, or precious metals (gold/silver) in an attempt to store value and hedge personal/private liquidity.

Truly we live in interesting times, ;however once we break through the 0 to negative -2 range things will really get interesting when the next major recession comes round and governments worldwide try negative interest rates.

I spend spend half my time in a place where it's mainly cash (small town in Germany) combined with FX fees (yes, I could go for another card but there's all that inertia...) means most of my transactions are cash. On the UK side, all but a minor amount of spend is now cash, eg the last 2 taxi rides i took. It's just quicker and easier to do cash than to wait for them to sort out the machine connections.

Interesting - In the old days, I believe the handling costs for debit cards were fixed per transaction - something like 30p - which made them cheaper than cheques for most businesses. Visa and Mastercard used to charge fairly significant fees, I think - I seem to remember figures like 3-5% from my childhood.

Now -- if I'm correct from my very brief reading on the subject -- the overheads are always percentage-based, perhaps with an additional very small per-transaction charge of a few pence. There may be a small difference between credit and debit cards. But the charges are very small, almost always less than 1% for normal, even small, businesses. There is typically a small monthly rental overhead for owning a card-processing machine etc, but again, it's not substantial. People who are paying more should, I think, check whether they're getting the best deal. (Admittedly, systems designed for more infrequent, mobile and casual use, such as Stripe and Paypal, do charge a percent or two more.)

So, unless I've missed something, I agree with Terence - I don't have much sympathy for those complaining about the overheads a cashless society imposes on businesses! If you like, charge me £99.99 instead of £99 - I probably won't notice!

I also don't, personally, have privacy concerns, especially when it comes to ApplePay - I know they've gone out of their way to make transactions less trackable, and I guess Android may have done the same. So yes, Apple know more about me, but the merchants - I think - don't know really any more than if I'm using cash.

Do enlighten me if there's something I've missed, though.

Well, yes, if you have lived your whole life in a standard democracy, I guess you feel OK with almost impossible invasion of the privacy. If you had however lived under anything else, this would be a concern. Not a big concern, but you would prefer to pay for certain transactions using cash. That might be prescription-only drugs, alcohol or specific niches/services people are into.

The only barber within walking distance doesn't take card. Other than that, I don't use cash nowadays. It's nice.

@Edent Interesting to read about your perspective. Coming from Finland, I stopped using cash in 1994, when I got my first card. After that it was smooth sailing until 2013, when I moved to Dublin, Ireland, where suddenly half the places didn't accept cards (cabs, or not for small sums or whatever). Then I moved to Spain, and again pretty much everything works with cards, except for small sums, or when things are b0rkd. Cheques? Last time was in the 80s, lol.

They probably don’t but their school was slow to accept cards (don’t know if they do now actually) then cash was it. Also took a while for local buses to go cashless. Status quo is easier than change 🤔 Now they are old enough for their own bank cards, could likely ditch cash.

As an aside, a friend and I once had a discussion about how anonymous cash really was.

I don't know if the serial numbers of notes are read by the machine as they emerge from an ATM. I presume they are, but they certainly could be, if they aren't already. Suppose that you extract 6 x £10 notes one day, and a couple of days later, four of those serial numbers are found in the wallet of a drug dealer when he's arrested. How likely is it that they didn't come directly from you?

Fun topic for pondering in a pub...

i genuinely prefer using cash. it makes for one less advertising data collection point.

I’ve done this almost accidentally for nearly the last two years now. The only exception has been local sales on things like gumtree.

Is money dashboard good? I am in the market for a good app. Also, I barely use cash as well. Couple places have been overseas (and was needed) but most places never needed it.

Yes, I love it. Takes a bit of setting up to get it just right. But very useful.

Cashless really hurts the homeless community.

I donate via payroll giving to a couple of homeless charities. I think they’re better placed than me to assess who is in need, and what resources are best.

Oh this is interesting. I didn’t make a conscious decision to avoid cash, but I’ve almost entirely stopped using it.

Two exceptions: nail bar (and thy started taking card mid-year), and local chip shop which is steadfastly cash only.

Amsterdam is almost entirely cashless. See:

I'm seeing more stores being card only. Seems like a sensible move to me. I've consciously avoided places which are cash only.

Same. Except the local chippy, which I visited about once a quarter. But no longer what with moving to a different, mostly cashless country and all.

I listened to an interesting radio 4 thing about cashless economies. Sweden I think pushed very hard and now regret it - folk got left behind. Their advice to places like the UK was to manage the transition gradually.

Absolutely something to be wary of. Personally I wouldn’t want to see cash disappear. I just prefer the convenience of not using it.

It's one of those intriguing things where obviousness isn't obvious. People seem to agree that simpler, quicker etc is good - but some of us think that means avoiding cash while other see that just as clearly as meaning that cash is the answer.

Meanwhile, data! It turns out that in 2013 (the earliest year it's easy to compare) I took out almost exactly three times as much cash from ATMs as I did in 2019. And my only surprise it that that ratio isn't higher.

No: kebab shop’s phone line is dodgy, which means card transactions do not always work. I carry one meal’s worth of cash, for such emergencies.

There's also another aspect. In a cashless society, if two parties want to transact they will always require the services of a third party, with cash they don't.

In terms of cheques, would you consider a bank account with an app which let’s you pay in cheques that way? Barclays does this, and perhaps others do too.

No. Anyone who pays me via cheque is intentionally inconveniencing me. I'm not going to change my banking habits because of one or two laggards.

Until you want to pay the cash in somewhere.

I’m mostly cashless except for occasional lunch at the market. I carry a bit of emergency cash usually for tea on the train. Changed a small amount of cash for travel & bought most of it back. Buy gloves hats etc for homeless & semi regular coffee for a guy on our local bridge.

Also mostly cashless.

Exceptions: nail bars and the corner shop for a pint of milk.

I’ve not gotten cash out since well before we moved and I don’t even know where the nearest cash point is.

Same for travel, never take money with me, get it out via ATM when in country if needed.

More times than not, I can go cashless abroad as well.

The two parties can transact in money rather than barter in goods precisely because there is a third party authority behind the cash. Though that third party doesn't, of course, have visibility of individual transactions.

I've already got to the point where using cash feels remarkably quaint. That said, I've very against places that are card only as it's painfully exclusionary to the significant number of people who, for whatever reasons, can only use cash.

Mostly cashless but I notice it most when far from london/in villages/rural transport then it ends up being a big palaver and I feel like Town Mouse/ a bit of a prat.

That and donating, though local big issue seller has got himself a card machine

It’s doubly problematic here as many shops are card only but don’t take Visa or MasterCard - only Maestro - so if you don’t have a local card you’re screwed.

In the Falklands I'm almost cash-less, but I'm also almost card-less too because here we pay by Cheque or Bank Transfer Slip (or a case of beer) for most things.

That sounds... Interesting...!

The Big Brother-ish-ness of a cashless society worries me

Sure, but that's been the case for centuries.

I hated it when I first arrived and relied on weekly withdrawals of cash (over the counter - no ATMs here) because SCB don't even issue debit cards unless you've been here six months. Since then I have fully embraced the cheque-book life and never bothered to get a card!

It's a simple way of life built on trust. You never pay in advance for things and there's usually only one provider. In a small community, it works.

Oh and on beer as currency, the standard price of a favour is a crate of Budweiser (24 cans). Usually costs around £10-14 in the shops.

And the Post Office used to have a nice little business collecting cash from shops so that it could pay out pensions and benefits and charge commission at both ends. Which was fine as long as the cash kept cycling.

Am about 95% of the way there already…..

I rarely carry cash nowadays. There’s contactless effectively everywhere to not warrant carrying it anymore.

Japan is almost entirely a cash based society. Cards do work. Lots of people won’t accept them. Period.

I always carry a little bit of cash.

Cash doesn’t stop working because of overloaded phone lines or because someone crashed their car into a junction box.

No one is going to render your cash useless by waving a magnet at it.

Cashless tech is too vulnerable.

Good read. I too find that I have no need for cash these days. Businesses who don’t take card will typically not get my business.

Last time I went to Rome it was fine. All the restaurants, bars, and museums took card.

Restaurants and museums I agree. Bars, you have been lucky. Taxis is quite uncommon (even if it would be mandatory for them, but good luck reporting them!). Supermarkets and chains, ok too. It's small shops that make it difficult.

Taxis I just used whatever app wasn't Uber.

Small shops were fine with me paying by contactless.

Although, we did check in the window / till to see if they took card.

Good luck travelling to Italy😅

The only places where cash was taken in NZ was artisan/craft markets and surprisingly, even some of them had their own eftpos machines.

Having lived in NZ for last 7 years & returned home to Ireland, it’s a culture shock that so many outlets that won’t accept cards. And 12c fee per ATM withdrawal transaction. NZ is 99% cashless. They don’t tip there either (they just pay their staff a good wage).

Nope, I live in Switzerland. Cash is King, unfortunately.

Really? I always imagined Switzerland as being quite technologically advanced.

Yes to most of this. Additionally:

My day-to-day contactless payments are mostly with my K-ring (https://mykring.com/en/) which is a few years old but still looks like magic when I use it and even in hipster coffee shops it gets a few cashiers boggle-eyed.

I also carry a single bank debit card in a slim leather card sleeve (with frequent-use loyalty cards) for the occasions when the K-Ring doesn't work and I restrict this card to holding up to £200 at any time.

I find that coffee shop apps (Neros and Coffee #1) are easy and reliable for payments and loyalty.

with K-Ring & that debit card & the apps I can keep all the small transactions off my main bank statement - decluttering. It also helps me keep track of how all those small daily payments are adding up.

There's a bit of work setting up some standing-orders and auto-top-ups and alerts but it all works pretty smoothly.

If I ran a small high street business I would of course have contactless but I understand that not everyone wants to do that and it's up to them if they prefer cash. My barber doesn't take contactless. Her main skills are hair-cutting and chatting and I'm not going to change barbers because of a payments issue. A man needs a reliable barber!

However, almost every day I carry cash and then don't use it - will try to be inspired by you, Terence.

Love the look of that Kring - although a bit expensive. I've been playing with NFC nails... Wonder if I can clone my card to one of them!

"refer a friend code" - 15% discount: K-JE5E1E (anyone can use it)

and if you keep an eye on the site they have a sale from time to time.

Caveat: I've found that just with normal use the ring (it's ceramic) can crack after about 12 months of daily wear. But so far I have always had a free replacement, no questions asked.

It’s a mixed bag. (I visit regularly.) In and around Geneva you can get by without cash for a lot of things.

For most things yes, but in my local shops that sell meat and vegetables most require cash.

Yup cheques and cabs are my cashless blocker as well!!

But my bank now let’s me pay cheques in by self scanning them in their app.

So just cabs to fix!!!

Paying a Taxi with the CC ist super difficult in Geneva. You have to ask 3-4 Taxis until you find one that accepts card.

In small shops you often have to spend a minimum of CHF 20 to be allowed to pay with the card (debit and credit)

But the TPG is easy.

(I really don’t use taxis. )

Yesterday, a cash machine swallowed my card. Their app let me cancel it and order a replacement immediately, but it'll take a few days to get printed and arrive.

I only use my debit card, so I don't have a fallback. Without having a little cash, I'd find it very difficult to live the next few days.

2 years cashless 🙏 now in Germany

Car parks! I usually park in the same car park in my local town centre, but recently parked in a different one as it was closer to the shop that I had a large delivery to pick up and I had the baby with me. When I got back and went to pay the machines all took cash only

I've had too many run ins with banks which do digital fail, hence a bit of cash can be handy

especially as most Link ATMs run on one system

I haven't used a taxi or gone to a restaurant in a long time so those have removed two of the main barriers to going cashless. I don't know if the extortionate fees for handling card transactions (particularly low value) for small businesses have dropped though.